FAQ - MAIN MENU

How does your model use facts and logic to minimize the odds of repeating common and emotionally-driven investment missteps?

The University of Chicago’s Richard Thaler was awarded the Nobel Prize in economics in October 2017 for his pioneering work in behavioral economics. Morningstar noted how Professor Thaler's work can assist investors:

"Unfortunately, our increasing sophistication has brought with it an additional unfortunate consequence: a tendency to be too conservative. This is where Professor Thaler’s research has been so revealing. He showed that investors become increasingly risk-averse the more closely they follow the market and their portfolios’ value. I need not point out how easy it now is to track the daily — if not hourly — gyrations in both the overall market and our individual portfolios as well. Unless we’re careful, therefore, one effect will be that we have become more conservative — not just when we think a bear market is imminent, but on average over time. And that would be costly, since it means we’ll earn a far lower rate of return than we would have otherwise.”

Most of us have worked extremely hard for many years to build our investment portfolios. Combining blood, sweat, and tears with what can be an overwhelming amount of economic/technical data to consider, well-intentioned investors often make emotionally-charged decisions in the financial markets.

COMMON INVESTOR MISSTEPS

Watching the markets too closely

Checking account balances frequently

Checking profit/loss frequently

Reading every bearish article

Reading every bullish article

Focusing solely on valuations

Worrying about what everyone else is doing

Worrying about what everyone else is saying

Trying to avoid volatility

Constantly worrying about the next correction

Constantly worrying about the next bear market

Getting spooked by normal volatility

Concerns about short-term pullbacks

The common missteps above tend to keep investors focused on short-term outcomes, which magnifies the emotional impact of normal volatility within the context of a long-term bullish trend. The same missteps can make it hard to discern between a healthy uptrend and low-probability environment marked by long-term downtrends.

The CCM Market Model uses present-day data to help us discern between volatility to ignore, within the context of an existing and ongoing uptrend, and volatility to respect that requires some form of incremental defensive action.

The model leverages the power of market fractals to monitor/assess volatility on multiple timeframes. Since our decision making process relies on objective market data, we can minimize the impact of the common human missteps outlined above.

The Perils Of Myopic Loss Aversion

Watching the market tick-by-tick and/or checking account balances frequently brings our natural defense mechanisms to the forefront, which can lead to placing a high priority on avoiding short-term portfolio drawdowns. From Morningstar/MarketWatch:

“The reason for this is a behavior pattern that Professor Thaler called 'myopic loss aversion,' which is in turn a combination of two personality traits that almost all of us possess: We hate losses more than we love gains, and, given the chance, we can’t resist looking to see how our investments are doing. As a result, frequently checking our portfolio’s gains or losses is not a benign act; it instead tends to exaggerate our subjective perceptions of risk.”

Below is the abstract from a 1997 Thaler paper, The Effect Of Myopia and Loss Aversion on Risk Taking:

“Myopic loss aversion is the combination of a greater sensitivity to losses than to gains and a tendency to evaluate outcomes frequently. Two implications of myopic loss aversion are tested experimentally:

1. Investors who display myopic loss aversion will be more willing to accept risks if they evaluate their investments less often.

2. If all payoffs are increased enough to eliminate losses, investors will accept more risk. In a task in which investors learn from experience, both predictions are supported. The investors who got the most frequent feedback (and thus the most information) took the least risk and earned the least money.”

Taking A Long-Term View Can Help

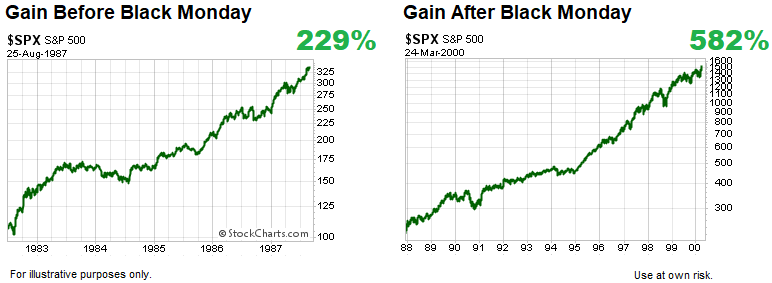

Investors are constantly bombarded with scary warnings about impending gloom and doom, providing fuel for a short-term, avoid-volatility focus. If we monitor and understand longer-term trends, it becomes easier to focus on the possibility of substantial and satisfying gains occurring over several years. For example, we have all seen the scary 1987 “Black Monday” stock market crash chart, but few of us have seen the two charts below, which show the gains in the S&P 500 before and after the October 1987 plunge.

Important Disclosures: While the CCM Market Model is based on sound economic and investment principles, there is no guarantee any of the objectives, including limiting account drawdowns, will be met in the future. The terms odds and probabilities also speak to uncertain outcomes. Please see additional disclosures for more information.