VOLATILITY IS NEVER FUN

It would be great if the stock market moved in a consistent manner allowing us to calmly watch our account balances grow. Unfortunately, enduring volatility is a necessary evil for those looking to capture long-term investment gains.

VOLATILITY IS NORMAL

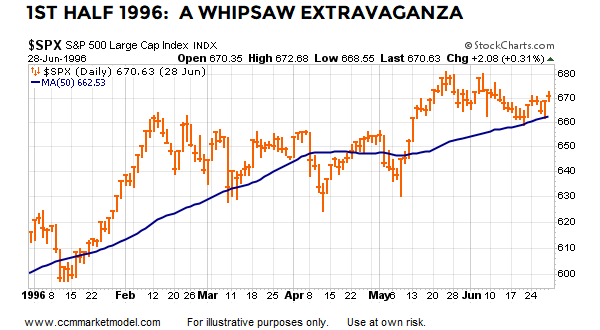

Calendar year 1995 featured a very strong trend in the S&P 500, similar to the strong trend that was present in 2017. We are all familiar with the expression the market needs to consolidate its gains, which is exactly what happened in the first six months of 1996. Between January 1, 1996 and June 30, 1996, the S&P 500 had 34 trading days that featured a move to or below the 50-day moving average. Easier markets (1995) are typically followed by harder markets (1H 1996).

CONSOLIDATION FOLLOWED BY ADDITIONAL GAINS

Harder markets (1H 1996) are typically followed by easier markets (2H 1996 - see chart below). While the second half of 1996 was easier than the first half, it was still no volatility cake walk. Between June 30, 1996 and December 31, 1996, the S&P 500 had 32 trading days that featured a move to or below the 50-day moving average.

DESPITE VOLATILITY, FULL-YEAR GAIN OF OVER 20%

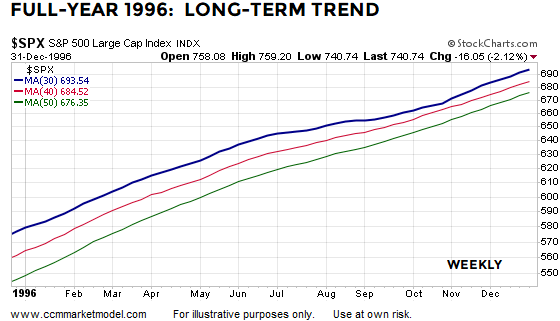

While the intermediate and short-term trends were volatile, the long-term trend remained intact, allowing the S&P 500 to gain 20.26% for calendar year 1996. The weekly chart of the S&P 500 below shows the 30, 40, and 50-week moving averages to illustrate basic concepts.

MARKETS ARE DIFFICULT

As shown via the charts below, trying to avoid volatility can be next to impossible in the financial markets if you wish to book satisfying gains at the end of the year. Under our approach and timeframe, it is best to make decisions based on the weight of the evidence, including multiple timeframes, asset class behavior, and risk-on/risk-off ratios.

MULTIPLE-YEAR VOLATILITY PROFILES DURING BULL MARKETS

Have you ever looked back after the market gains 20% and said to yourself how did I not capture more of that move? Did you look back after the 2000-2002 or 2007-2009 bear market and ask yourself how did I let myself lose that much money? This week’s video explains why those horrible experiences are so common in the stock market and covers methods to minimize the odds of repeating past investing missteps.

VIDEO CORRECTION: At the 13:31 mark, the summary table for CASE B should be 56% and 44% as shown here.