The S&P 500 entered a trading range on February 2. Inside a range, it is always prudent to run through a handful of potential outcomes, allowing us to have a strategic, psychological, and tactical road map. Road maps help us stay calm during stressful events.

- If a new bear market has started (TBD), we know with 100% certainty the S&P 500 would have to make a SUSTAINED move below the bottom of the range (2,532).

- If the bull market is simply on pause (TBD), we know with 100% certainty the S&P 500 would have to make a SUSTAINED push above the top of the range (2,801).

- Therefore, new information, from a price perspective, comes with a sustained push above the top of the range or a sustained push below the bottom of the range.

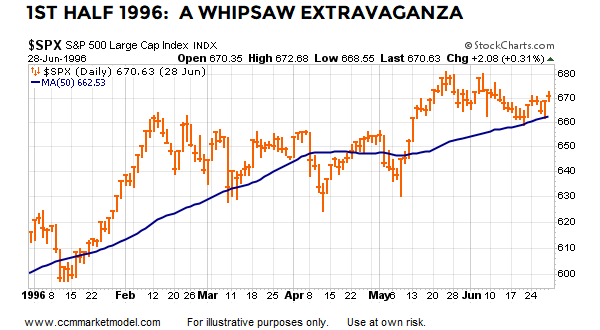

- We learn very little as price whipsaws up and down inside the range.

To move outside the range on Wednesday, March 21, the S&P 500 would have to gain 85 points or drop 184 points. Since those are pretty big moves, the odds favor closing inside the range after the Fed announcement (TBD).

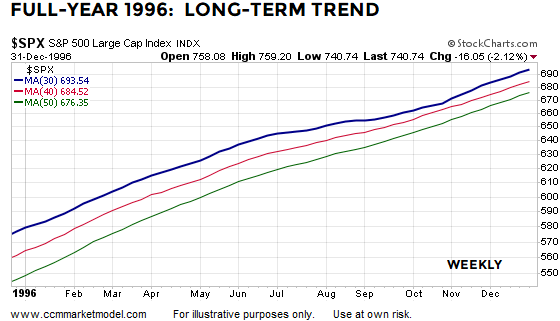

As outlined in numerous posts, the facts that we have in hand today (weight of the evidence on multiple timeframes), favor the SUSTAINED move occurring to the upside in a bullish manner. As we know, a lower probability outcome (new bear market) is always a possibility, which speaks to remaining open to all outcomes (day by day).

Even under a longer-term bullish resolution, it is possible the market will want to retest the S&P 500 low of 2,532. From a psychological perspective, it is also prudent to keep in mind that retests often involve a false breakdown.

A false breakdown could take the form of a relatively short stay (few minutes/hours/days) below 2,532, followed by a sharp and bullish reversal. Obviously, a move below 2,532 would be a high anxiety event for many, and thus, it is prudent for us to take a calm and measured approach if the S&P drops below 2,532 for a short period of time. That is why the term sustained is so important when price is in a range.

Under the low probability scenario (new bear market), the longer the S&P 500 stays below 2,532, the more meaningful it would become relative to increasing bearish odds.

The market was unquestionably in a strong bullish trend before the recent correction. Therefore, until proven otherwise, the base case remains a normal pullback/consolidation/resumption of bull market in the weeks/months ahead. That is not a forecast; simply a probabilistic statement based on the facts in hand. The term base case implies bearish cases must also be respected and accounted for (maximum flexibility).