MARKET’S TAKE: MONDAY AND TUESDAY

In this week’s video, we noted our approach would be data dependent if the market stayed between the upper and lower bounds shown below. As of the close on Tuesday, November 6, we have fairly constructive candles in 6 of the last 9 sessions, which is in sharp contrast to the extremely rare selling pressure seen in October.

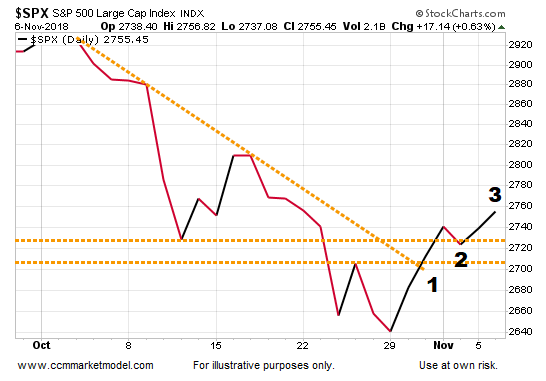

The S&P 500 has now successfully closed above both the 61.8% and 50.0% retracements.

The S&P 500 closed back above all the “areas of possible support” we have been referencing for several weeks.

The S&P 500 has broken a downward-sloping trendline, made a higher low, and a higher high.

During Tuesday’s session, a basket of growth-oriented stocks outperformed a defensive-oriented basket of bonds by 0.62%.

Heading into election night, SPY is beating TLT by 0.85% this week. Point C looks similar to the constructive looks at points A and B.

The Dow printed a higher high today and RSI closed above 50 for the first time in several weeks.

The Global Dow, thus far, is holding above the 2007 high. This is an ongoing retest that may take some time relative to a firm resolution.

The NYSE, thus far, is holding above the 38.2% retracement. Price has moved back into the orange box.

SPY appears to be trying to make a stand near a logical area.

After being lopsided for several weeks, market breadth is showing some signs of improvement.

Many of the concepts above are covered in more detail in this week’s video.

TOMORROW IS A NEW DAY

Additional information about recent portfolio adjustments can be found on the CCM Twitter Feed.