The hot topic on Wall Street this week was “blow-off top”. How concerned should we be about an end to a euphoric stock market rally? You can decide.

December 2019 Looks Nothing Like December 2018

WILL IT HAPPEN AGAIN?

Human beings tend to remember emotional events, especially painful events. December 2018 falls into the painful category, given the S&P 500 lost 14.92% between the end of November and Christmas Eve. Thus, it was unnerving for investors to see red screens in early December 2019.

THAT WAS THEN

From a “what are the odds it happens again” perspective, it might be helpful to compare December 4, 2018 to December 4, 2019. In the 2018 case, the S&P 500 closed below the 25, 39, 50, 75, 100, 125, 150, 175, and 200-day moving averages, which told us large institutions were very concerned about future market and economic outcomes.

THIS IS NOW

In the 2019 case, the S&P 500 is trading above the 25, 39, 50, 75, 100, 125, 150, 175, and 200-day moving averages, which tells us large institutions are optimistic about future market and economic outcomes. If we were taking a technical analysis test and were asked is the chart below an uptrend or downtrend, we’d think that’s easy, choose uptrend, and move to the next question. In real time, it is a bit more difficult because of the news cycle and our personal biases; regardless, the answer is still easy and it is still uptrend.

HOW ABOUT WEEKLY TRENDS AND MOMENTUM?

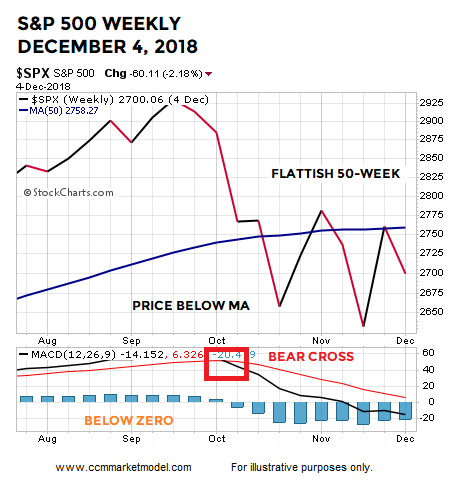

In the 2018 case, the S&P 500 was below a 50-week moving average that had a “we are concerned” look. Weekly MACD was in a “bearish cross” state and below zero, which told us the intermediate-term trend was at a higher risk of flipping to a sustained bearish trend.

WEEKLY LOOKS MUCH BETTER TODAY

The concept of a mirror image comes to mind when comparing the 2018 chart above to the 2019 chart below. In the 2019 case, the S&P 500 is above the 50-week moving average that has a “we have been getting more confident” look. Weekly MACD is currently in a “bullish cross” state. Weekly MACD is above zero, which tells us the intermediate-term trend is up and recent pullbacks have been countertrend moves.

MONTHLY TRENDS AND MOMENTUM

On December 4, 2018, the S&P 500 was below a “flattish to in jeopardy of rolling over” 10-month moving average. The market had recently experienced a bearish monthly MACD cross, telling us a bearish countertrend move was taking place.

2019 LOOKS MUCH BETTER

Once again, the evidence we have in hand today is a polar opposite to what we had a year ago. Instead of being below the 10-month, price is above. Instead of an indecisive/rollover look, the 10-month has a bullish/turning-up look. Instead of a recent monthly MACD bearish cross, the S&P 500 recently printed a bullish monthly MACD cross.

ODDS TODAY vs. A YEAR AGO

It is extremely important to note, the look of all the 2018 charts shown above was BEFORE the S&P 500 lost an additional 12.64%, telling us the odds of really bad things happening was significantly higher a year ago relative to the present day.

THESE CONCEPTS WERE HELPFUL IN JANUARY 2019

Charts cannot predict the future; they simply help us assess the probability of good things happening relative to the probability of bad things happening. December 2018 was the worst December since 1931 and the plunge in Q4 was rare from a magnitude perspective. It would have been easy to remain in cash for the first few months of 2019, given the weak data on December 31, 2018 and the severity of the Q4 2018 decline. Charts like the charts shown above were helpful in terms of helping us get back in line with the market. For example, the charts below were covered in a January 11, 2019 video and presented as part of a bull/bear road map that proved to be valuable throughout 2019.

The chart in the middle of the image above is dated January 10, 2019. If we looked at the same chart on April 1, 2019 (below), we can see how the evidence gradually improved between January 10, 2019 and April 1, 2019. The chart below said the odds of a sustainable uptrend were quite a bit better on April 1 relative to early January. Thus far, the uptrend has remained in place, meaning the April 1 chart was helpful.

Is it possible all the 2019 charts shown above begin to morph into more concerning looks similar to the concerning looks on December 4, 2018? Yes, it may happen and it may happen soon, but it has not happened yet.

OTHER FORMS OF HELPFUL EVIDENCE IN 2019

While it is never easy navigating near a major low (December 2018), the market has provided numerous “this does not look like a bear market” and “this does not look like a recession is underway” clues since January 11, 2019.

This Never Happened In The 1974, 2001, And 2008 Bear Markets

Rare Bullish Shift In P&F Buy Signals

Learning From The 1998, 2002, 2009, 2011, And 2016 Stock Market Lows

An Extremely Rare Move In Bonds, How Have Stocks And Bonds Performed In The Past?

What Typically Happens When These Charts Flip?

Are Institutions Selling Into This Rally?

Monthly Breadth: Dark Clouds Or A Ray Of Hope?

History Says Stocks Could Rocket Higher Over The Next Two Years

Do The Facts Support Gloom And Doom Or Higher Highs In Stocks?

2019 Market Action Points To Positive Long-Term Outcomes

The Bullish Message From The Stock/Bond Ratio

Are National Financial Conditions Saying The Stock Market Is In Big Trouble?

History Says Stocks Can Perform Very Well After Big Oil Shocks

Bulls Have Setups In Place For Monster Breakout

The Road Ahead May Be Brighter Than Expectations

Trade, Impeachment, And The Conviction Of Buyers And Sellers

Similar Drops In ISM Manufacturing Data

The Six Most Powerful Charts On Wall Street

Demographic Sweet Spot Says Bull Market Could Last Until 2035

Bulls Still Have Support For Upside Breakout

History Says Stocks Could Still Soar To Unimaginable Heights

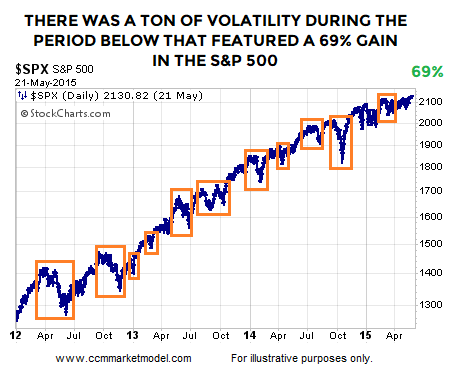

VOLATILITY IS A NORMAL PART OF ALL TRENDS

As outlined in the posts above dated between January 21 and November 4, the market and economy have provided numerous reasons to keep an open mind about better than expected outcomes. Now that stocks are near an all-time high, it can be easy to forget all the volatility that took place between those two dates. The moral of the story is even IF really good things happen in the weeks, months, and years ahead, we can expect a ton of volatility and scary headlines along the way. We will continue to take it day by day with an open mind about all outcomes, from wildly bullish to wildly bearish.

Rare Equity Fund Outflows

STOCK PERFORMANCE FOLLOWING SIMILAR MOVES

Retail investors have erred on the side of caution in 2019. From a recent MarketWatch article:

Analysts said the “extremely cautious stance” of retail investors this year had been puzzling and acted as a drag for equity markets… Years of high bond inflows, such as 2012 and 2017 — and now 2019 — have typically been followed by weak bond fund inflows the following year.

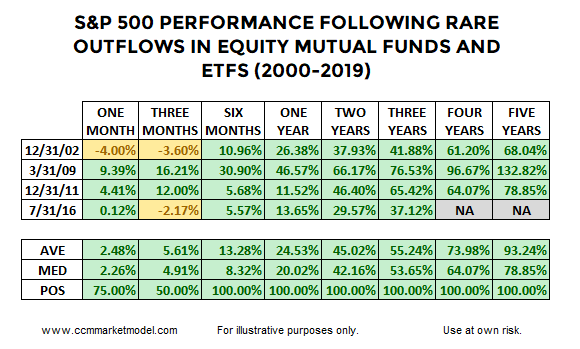

Not only have bond inflows been strong, but outflows from equity mutual funds and ETFs have come at a six-month pace similar to December 2002, March 2009, December 2011, and July 2016. The BNP Paribas chart below was posted on Mark Ungewitter’s Twitter feed.

Given unusually high rates of equity outflows align conceptually with unusually high rates of pessimism, it would not be surprising if stocks performed well walking forward from the four periods highlighted in the BNP Paribas graph above. The table below shows S&P 500 performance was quite attractive in all four cases.

The yellow portions of the table above help keep us grounded relative to how markets operate in the real world.

TODAY vs. SIGNIFICANT MARKET TOPS

It might be helpful to compare present-day equity fund flows to fund flows seen prior to the major stock market peaks in 2000 and 2007. As shown in the chart below, 2019 looks significantly different from March 2000 and October 2007.

REALISTIC EXPECTATIONS

After showing weak ISM Manufacturing Survey data was not necessarily a showstopper on October 1, the S&P 500 found its footing and made an intraday low of 2855 on October 3; from that low, the S&P 500 rallied 299 points, hitting the recent intraday high of 3154 on November 27. Some giveback or retracement after a 299 point move would not fall into the shocking category. Our focus is on longer timeframes.

VOLATILITY IS NORMAL, RATHER THAN ABNORMAL

In the historical cases shown above, was it a cake walk after fund flows reversed? No, walking forward from the end of December 2011, stocks rallied for over three years, but that move had plenty of normal-and-to-be-expected volatility between point A and point B. It is easy to look at the chart below and say, “Yes, we all know markets have red days and corrections during an uptrend”. It is a little bit harder to respect normal volatility when the market is open and your screen is covered in red.

WEIGHT OF THE EVIDENCE

The fund flows analysis above aligns with a recent study of stands near the 200-week, relatively high cash balances, and recycled DeMark counts.

WEEKLY VIDEO

The Thanksgiving week video opens with the possible significance of the monthly MACD cross that was nailed down after the Dow’s close on Friday, November 29.

DAY BY DAY

All of the above speak to probabilities, which is significantly different from certainty. We will continue to take it day by day with an open mind about a wide range of outcomes, from wildly bullish to wildly bearish.

This Signal Points To More Upside In Stocks

NEW MONTHLY SIGNALS

The MSCI World Index tracks over one thousand large and mid-cap stocks in twenty-two developed countries, covering 85% of the market capitalization in those regions. As shown via the chart below, a positive monthly MACD cross was just nailed down on the chart of the MSCI World Index, which speaks to improving perceptions of future economic outcomes outside of the United States.

Since the inception of the MSCI World Index, there have been five similar monthly MACD crosses. Subsequent S&P 500 performance was favorable in every case looking out one month to two years. The median S&P 500 gain one year after the previous signals was 19.42%.

SIMILAR SIGNAL IN THE UNITED STATES

The opening segment of this week’s stock market video covers a similar bullish signal completed at the end of November on the monthly chart of the Dow Jones Industrial Average. Unlike the limited data set of the MSCI World Index, the Dow allows us to see how the stock market performed following similar monthly signals dating back to 1948.

THE WEIGHT OF THE EVIDENCE

The signals covered above align with the signals covered on November 17 and November 24, telling us to keep an open mind about better than expected outcomes in the months ahead, while maintaining a healthy respect for normal volatility.