PRUDENT vs. PANIC

As noted on December 5, Tuesday’s big drop increases the odds of the S&P 500 taking another significant leg down. Thus, we have to be open to the possibility in the coming days and weeks that all four 2018 lows shown in this post will be violated. Notice the previous sentences contain the terms odds and possibility.

As covered in detail on November 23, from an ugly chart pattern, including one with price below a downward-sloping 200-day moving average and numerous high-selling pressure red sessions, really ugly things can happen and surprisingly favorable things can happen if the newscycle flips the script on something that is bothering the market.

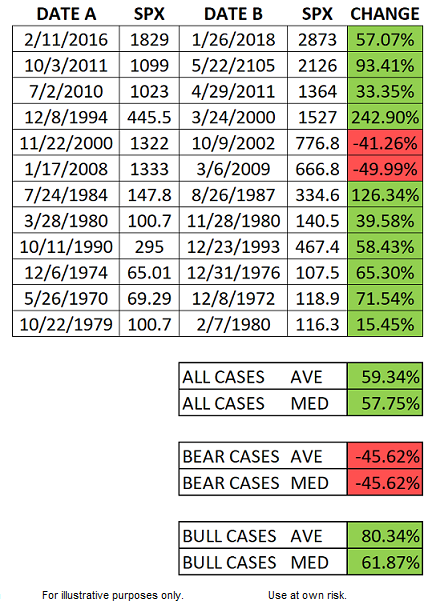

The November 23 video covered 13 cases, 12 historical and 2018. To help us keep an open mind and remain tactically and psychologically prepared for ALL outcomes, it is helpful to revisit the summary “what happened next” table regarding the 12 ugly historical setups.

As history clearly demonstrates, our plan must be able to handle a wide range of outcomes from seeing the S&P 500 drop an additional 40% to 50% to seeing something flip in the newscycle which could trigger a rally leading to gains between 60% and 80%. In all the historical cases above, it felt terrible and there appeared to be little hope of a rally, and yet, in 10 of the 12 cases something improved in the newscycle and the market’s technicals improved quickly. We saw an example of the newscycle flip recently when the Fed chairman made some favorable comments and stocks rallied sharply.

A HIGH DEGREE OF CONFIDENCE

Basic logic tells us if the S&P 500 is going to drop an additional 40% to 50% from Tuesday’s close, all four 2018 lows below will be violated. In that scenario, we do not know how they would be violated (normal downtrend vs. big gaps down). None of these levels were violated at the open on Thursday, December 6, 2018.

Downtrends make a series of lower lows. Thus, each time a low is violated, the present day starts to look more and more like a long-term downtrend versus a wide range of consolidation that we have today.

Everyone is watching the same basic charts, which means stops tend to be set near the same levels, which can trigger somewhat of an air pocket or cascading effect near those levels. Often after all the stop orders are triggered, the market can find a bid (all TBD). Thus, under our approach, we do not use hard stops and we do not choose the most obvious levels as “time to act” triggers. We also take into account the possibility that key levels are often violated for a short period of time (a few hours or a day or two) only to be followed by a rally.

We have a very specific game plan based on numerous logical levels, allowing us to prudently balance and account for a wide range of possible outcomes, from wildly bearish to wildly bullish.

As of Tuesday’s close (markets were closed Wednesday), the S&P 500 was above all four major 2018 lows. That may change in the coming days and weeks, but it has not changed yet. It is important that we let logic, rather than emotions and red screens, dictate our actions during periods of high stress and anxiety.

As shown via the table below, the S&P 500 would have to fall 168 points on Wednesday to make a significant lower low below the February 9, 2018 low of 2532. A drop of 168 points is possible and we are prepared for all outcomes over the coming sessions. We are not making any assumptions about whether or not areas of possible support will hold or be taken out - they are simply reference points. We will to stick to our well-constructed and prudent plan while remaining cool, calm, and collected.

This post is written for clients of Ciovacco Capital Management and describes our approach in generic terms. It is provided to assist clients with basic concepts, rather than specific strategies or levels. The same terms of use disclaimers used in our weekly videos apply to all Short Takes posts and tweets on the CCM Twitter Feed, including the text and images above.