DEC 19: MARKET’S INITIAL REACTION TO FED

The Fed appeared to play a role in the stock market’s rapid descent that began in earnest in early October of this year. Based on early returns, the Fed seemed to once again greatly underestimate the market’s concerns related to the economy and monetary policy. From a Bloomberg opinion piece regarding the December 19 Fed statement/rate decision/press conference:

The first big shock came at 2 p.m. New York time, as the Fed statement was released. That eliminated the slight hope that the Fed might decide not to hike at all. Also, the statement was just barely more dovish than the previous one from the Fed.

Implicit in this response was Powell’s belief that the steady move to reduce the Fed’s balance sheet assets and, hence, mop up liquidity, was not going to roil the markets.

As for the accompanying “dot plot” of economic projections, it was more dovish than its predecessor, but still suggested that policy makers fully expected to boost rates two more times next year.

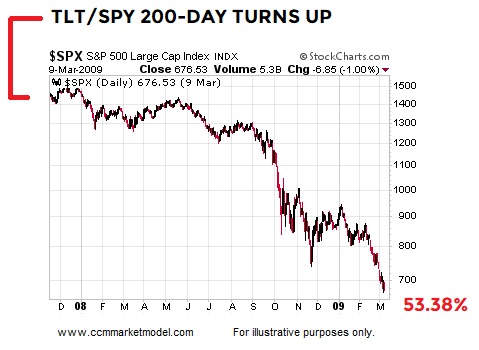

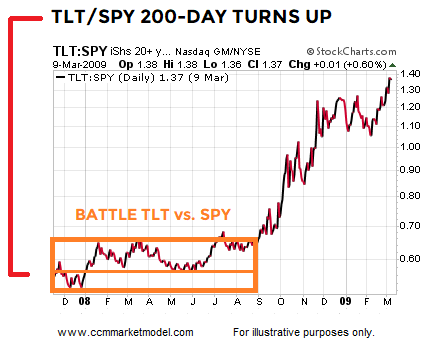

But the underlying message of the stock market is still emphatically that the Fed is wrong, and that the chances of an imminent downturn are increasing.

THIS IS NOT A FORECAST/PREDICTION OF GLOOM AND DOOM

The intent here is not to imply the S&P 500 will drop an additional 50% from present-day levels. As noted above, history tells us:

Every correction does not morph into a bear market.

Every bear market does not morph into a crisis.

Stock market corrections/bear markets can end at any time.

Bear markets/corrections often produce sharp/large countertrend moves.

The point of the exercise is to demonstrate what can happen when long-term trends from multiple areas of the market begin to reflect concerns about the economy and/or monetary policy. The charts above speak to probabilities, which is quite a bit different than certainty. Comments and concepts from December 16 and December 22 still apply.

This post is written for clients of Ciovacco Capital Management and describes our approach in generic terms. It is provided to assist clients with basic concepts, rather than specific strategies or levels. The same terms of use disclaimers used in our weekly videos apply to all Short Takes posts and tweets on the CCM Twitter Feed, including the text and images above.