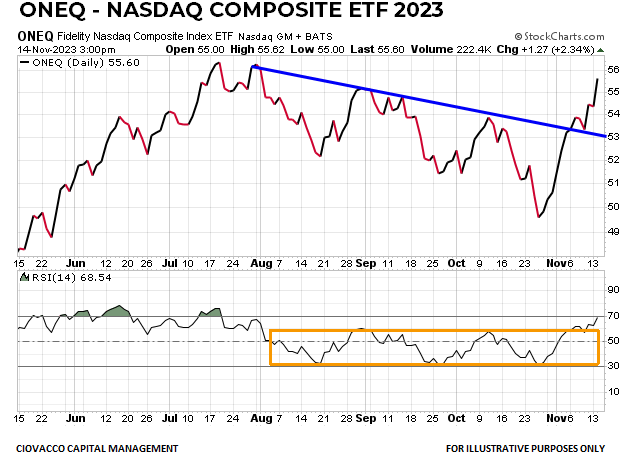

The NASDAQ Composite (ONEQ) chart below was shown in late October to highlight an area of possible support, based on anchored volume weighted average price (AVWAP) data.

The updated November 14 version below shows buyers did eventually step in the crucial bull/bear battle zone. Given the high correlation between the NASDAQ Composite and the Invesco NASDAQ 100 Trust (QQQ), the outcome thus far is good news for the popular tech-heavy ETF.

In recent sessions, SPY also made a stand at a similar bull/bear battle zone but was unable to clearly exceed the AVWAPs relevant to the intermediate-term downtrend that began in late July. That changed after the better-than-expected CPI report, which propelled SPY well above the area of congestion near point C in the graph below. The positive development tells us the odds of the July 2023 correction being over have improved significantly. The longer SPY can hold above point C, the more relevant it becomes.

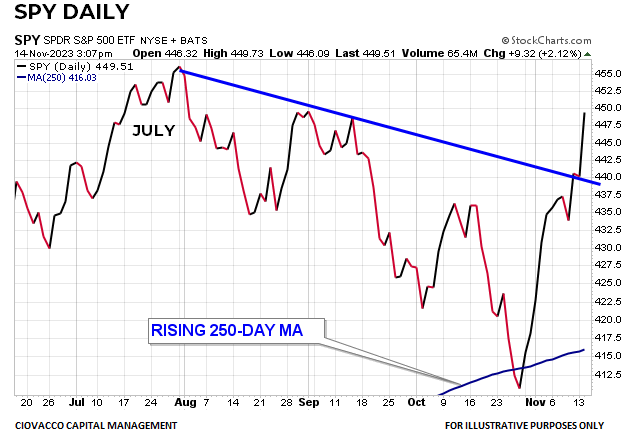

The traditional SPY chart below illustrates a change in character evident after Tuesday’s session. Price breached the 250-day moving average in October but followed that with a multiple-session push higher of rare magnitude.

Similar improvement can be seen on the ONEQ chart below with price breaking above the downward-sloping trendline from the July 2023 peak. It is also a good sign that the relative strength index (RSI) was able to push above the orange box, which is indicative of stronger buying conviction relative to what was seen in August, September, and October 2023.

Small caps (IWM) have thus far held above an important support/resistance region that dates back to 2018. IWM has underperformed significantly and may be due for a period of outperformance.

The strong dollar has been a headwind for numerous ETFs in recent weeks. As illustrated on the U.S. Dollar (UUP) relative to the S&P 500 (SPY) chart below, that headwind may be flipping over to a tailwind. In 2016 and 2020, it was a good sign for risk assets when the UUP:SPY ratio moved below and away from the downward-sloping 200-week moving average shown in red. The chart has a similar look in 2023.

The better-than-expected CPI report impacted expectations related to inflation, Fed policy, interest rates, and the U.S. dollar. The shift in expectations may provide a lift for many foreign ETFs. Relative to the market’s risk appetite, it is a good sign that the Vanguard Total World Stock ETF (VT) recently made a stand near an upward-sloping 200-week moving average, which is indicative of a secular bull market and aligns with demographic trends.

Ultimately, bull markets are about risk appetite; the same can be said for rallies off intermediate-term stock market lows. The 2007-2009 financial crisis bear market resulted in an S&P 500 drawdown of approximately 50%, something most investors would like to avoid. When the S&P 500 peaked in October 2007, the conviction to own defensive consumer staples (XLP) picked up significantly relative to the conviction to own the S&P 500 (SPY). Notice how the XLP:SPY ratio turned up sharply in Q4 2007 and quickly exceeded the 50-month moving average. In 2008, the 50-month moving average started to turn up in a risk-off manner. If we compare the increasing-fear look in 2007-08 to the look in 2023, we see they look nothing alike, which tells us economic and systemic concerns were greater in late 2007 and early 2008.

Similar risk-off relative to risk-on characteristics can be seen on the chart of high yield bonds (HYG) below. In early 2022, the slope of HYG’s 250-day moving average rolled over in a bearish manner. In 2023, the 250-day is turning up in a constructive manner. After Wednesday’s CPI report, HYG cleared a multiple-month base (blue box) and printed a new closing high, which speaks to decreasing concerns about the economy and bond defaults.

As noted in the November 13 tweet below, favorable setups on the chart of the iShares Core Aggregate U.S. Bond ETF (AGG) said be open to favorable CPI data and a favorable reaction in the bond market.

The chart below shows the performance of SPY relative to 3-7 year Treasury bonds (IEI). The SPY:IEI ratio broke out of a multiple-month base in June 2023. It appears as if the ratio has successfully retested the breakout zone (see green arrow).

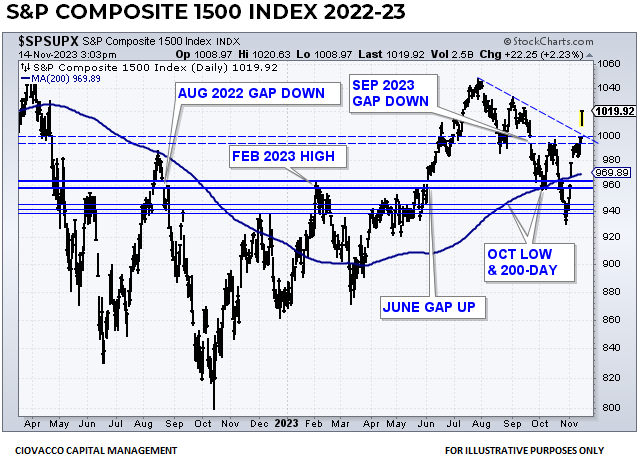

One of the legitimate concerns raised by bears in recent months has been weak stock market breadth (fewer stocks participating in rallies). If breadth is going to improve, a breakout in the broad S&P Composite 1500 Index (SPTM) is a good place to start. After CPI, SPTM gapped above the downward-sloping trendline tied to the July 2023 high. In recent sessions, SPTM recaptured the upward-sloping 200-day moving average, which increases the odds of the prior bullish trend reasserting itself.

Moral of the Story

After taking out some important levels and inflicting significant damage to the technicals, the market found its legs near the critical areas outlined on October 30. The developments following the better-than-expected CPI data increase the odds the primary bullish trend is in the process of retaking control.